Your new post is loading...

The international financial regulation of SPACs is evolving, and it tends progressively to be more focused on retail public investors. This shows a new political side of SPACs in determining the outcome of future outflows and inflows of capital between countries. Furthermore, it gives rise to competition between national regulatory frameworks to ensure that the magnetism of capital inflows correlates with the most SPAC-friendly legal regime. The UK aims to position itself as the new HQ for European SPACs.

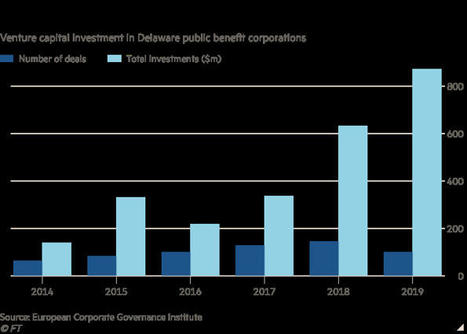

While more companies are adopting stakeholder-friendly mandates, they remain exceptions to the rule, with the industry still confused about the exact meaning of such alternative structures. When Lemonade launched its initial public offering in 2020, the US home insurance start-up saw its market capitalisation double in the first morning’s trading to $3bn, far above the private market valuation it had secured from early investors such as SoftBank. With bots signing up customers and managing claims, Lemonade uses artificial intelligence to maximise underwriting efficiency. After paying claims, it gives any leftover money, up to 40 per cent of premiums, to charity. It is a disrupter in another way, too. Rather than being classed as a C or S Corp, as is usual for large US companies, Lemonade is incorporated as a public benefit corporation (PBC). State laws in Delaware, where more than two-thirds of Fortune 500 companies are incorporated, dictate that a PBC must balance the financial interests of shareholders with the interests of other stakeholders, such as employees, customers and the environment. It must pursue a specific social or environmental purpose that is identified in its corporate charter.

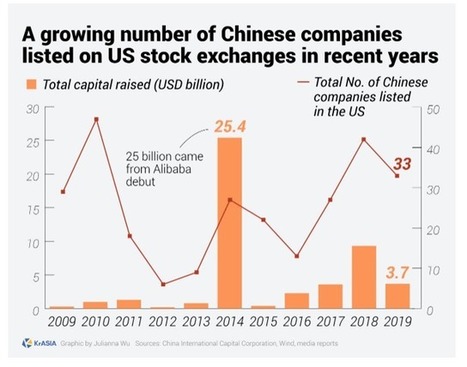

(Bloomberg) -- For two decades Chinese tech firms have flocked to the U.S. stock market, drawn by a friendly regulatory environment and a vast pool of capital eager to invest in one of the world’s fastest-growing economies. Now, the juggernaut behind hundreds of companies worth $2 trillion appears stopped in its tracks. Beijing’s July 10 announcement that almost all businesses trying to go public in another country will require approval from a newly empowered cybersecurity regulator amounts to a death knell for Chinese initial public offerings in the U.S., according to long-time industry watchers. “It’s unlikely there will be any U.S.-listed Chinese companies in five to 10 years, other than perhaps a few big ones with secondary listings,” said Paul Gillis, a professor at Peking University’s Guanghua School of Management in Beijing.

Regulations need updating – but not like this

The government has begun hunting for ideas to bolster London’s reputation as a global finance center, in a series of reviews and consultations on a variety of issues, including I.P.O.s and trading regulations.

BlackRock’s long road to green leadership has passed another milestone. The $9 trillion asset manager on Wednesday said it would require companies which emit lots of carbon dioxide to set nearer-term targets for cutting greenhouse gases, as well as more fully disclosing their true emissions. That’s progress, but BlackRock can still go further.

Corporations have something to say about some of the most important social and economic issues of our time—and one way they say it is through shadow governance. This Article spotlights a group of influential corporate policies comprising what we call “shadow governance.” These non-charter, non-bylaw governance documents express a corporation’s commitment to and process on issues as wide-ranging as campaign finance, environmental sustainability, and sexual harassment, but are largely overlooked by scholars and practitioners alike. This Article addresses that gap, revealing how shadow governance documents influence corporate decision-making and corporate behavior. [...] This Article’s exploration of shadow governance documents is both theoretically and practically important. Shadow governance documents are not just poorly understood—they are also largely overlooked by scholars and practitioners. This Article’s account has the potential to open a new field for scholarly research and to provide new strategies for those who wish to influence corporate behavior.

The Senate passed a bill that could lead to the delisting of foreign companies listed on American markets. A deeper dive into the regulatory framework in China reveals the true details of the conflict. Collaboration between the regulators of the two nations is the only way forward to resolve this matter. The rising tensions, however, paint a bleak outlook. The United States still remains the most desirable destination to raise capital, and listing a company's equity securities on a U.S. stock exchange is considered the "gold standard". Considering the stellar economic growth of China in the last couple of decades, it didn't come as a surprise when companies with roots in China opted for American markets to raise capital. The number of Chinese companies listed on U.S. stock exchanges has grown consistently in the last 8 years.

Dual-class stock enables a company’s controller to retain voting control of a corporation while holding a disproportionately lower level of the corporation’s cash-flow rights. Dual-class stock has led a tortured life in the US. Between institutional investor derision and the exclusion or restriction of dual-class stock from certain indices, one may assume that dual-class structure must be harmful to outside stockholders. However, in this article, the existing empirical evidence on US dual-class stock will be reassessed by contrasting studies that use different measures of performance. It will be shown that although dual-class firms are generally valued less than similar one-share, one-vote firms, they perform as well as, and, in many cases, outperform, such firms from the perspective of operating performance and stock returns. When it comes to dual-class stock, more than meets the eye, and a presumption that dual-class stock is harmful for outside stockholders should not guide policy formulation.

According to a recent study by one of the nation’s largest auditing firms, scandals, misconduct, and ethical lapses are now the biggest drivers behind executives being pushed out of their positions.

The Council of Institutional Investors (CII) has asked the SEC to seek authority enabling the commission to, in effect, require companies to limit the length of time company founders can exert outsize control over companies after they go public. CII general counsel Jeffrey Mahoney notes in a letter sent to the SEC earlier this month that the group last October submitted listing-standard petitions to the US stock exchanges asking them to propose new rules that would require newly listed companies that choose dual-class voting structures to adopt a sunset provision that clicks in within seven years of an IPO.

The demise of dual class has been greatly exaggerated

Following a post-Google decade of increasing use of multi-class structures to ensure that visionary founders continued to hold control of their companies after IPO, the public investment world came down hard on dual class. Accordingly, we saw a lull in dual-class offerings and what might indicate the beginnings of a return to one-share-one-vote pervasiveness. [ ... ] Based on our estimates, we expect 15–20% of companies planning for an IPO in the next few years to adopt a dual-class capitalization structure, rivaling or exceeding the levels we saw in 2012–2018.

Some of the most prominent companies of our era use them, from Facebook and Alphabet to Berkshire Hathaway. So did seven of the 10 biggest IPOs this year, including Lyft, Pinterest and Levi Strauss.

|

The main downside of DCSS has been that, pursuant to Listing Rule (LR) 9.2.21R, companies with such structures are prohibited from listing on the London Stock Exchange's premium segment – the UK gold standard for corporate governance (there are no restrictions on DCSS on the standard segment).

Not being part of the premium segment means companies cannot be included in FTSE indices and accordingly their shares will not be bought by tracker funds.

[...] I want to present ten theses for your consideration and our discussion this afternoon. I will lay these theses out without much sugar-coating precisely to spark a textured conversation about the complexities and consequences of a potential ESG rulemaking.

I. Thesis 1: ESG as a category of topics is ill-suited, and perhaps inherently antithetical, to the establishment of clear boundaries and internal cohesion.

II. Thesis 2: Many ESG issues lack a clear tie to financial materiality and therefore do not warrant inclusion in SEC-mandated disclosure.

III. Thesis 3: The biggest ESG advocates are not investors, but stakeholders.

IV. Thesis 4: ESG rulemaking is high-stakes because so many people stand to gain from it.

V. Thesis 5: “Good” in ESG is subjective, so writing a rule to highlight the good, the bad, and the ugly will be hard.

VI. Thesis 6: An ESG rulemaking cannot resolve the many debates around ESG models, methodologies, and metrics.

VII. Thesis 7: Emotions around ESG issues may push us to write rules outside our area of authority.

VIII. Thesis 8: ESG issues are inherently political, which means that an ESG rulemaking could drag the SEC and issuers into territory that is best left to political and civil society institutions.

IX. Thesis 9: ESG disclosure requirements may direct capital flows to favored industries in a way that runs counter to our historically agnostic approach.

X. Thesis 10: An ESG rulemaking could play a role in undermining financial and economic stability.

Mention Engine No. 1’s victory over Exxon Mobil Corp. last month to the socially conscious investing crowd and they’ll rattle off a wish list of targets that have so-far resisted calls to reform their social practices.The possibilities include Twitter Inc., Facebook Inc., Netflix Inc. and private prisons, to name a few.

Shareholder proposals highlight tensions between asset managers promoting ESG disclosures and executives who are pushing back

Royal Dutch Shell is changing the senior leadership of its operations in Britain as part of a global overhaul to cut costs and shift away from oil and gas to renewables and power.

More than a decade ago, such share structures — in which leaders get more voting potency than other shareholders — were largely reserved for a tiny number of startups, typically the ones most coveted by investors, like Google and Facebook Inc. Airbnb, DoorDash, Palantir and a string of other recent listings show how so-called founder control has effectively become the norm.

Facebook shareholders have been urged to rebel against the company's "dysfunctional" governance structure by opposing its board compensation policy this week, ousting Mark Zuckerberg as chairman and withholding support for some directors. Influential investor groups ISS and Glass Lewis have advised shareholders to support a resolution requiring an independent board chairman at its annual meeting on Wednesday (US time), a proposal that would effectively block Facebook's founder and chief executive from also holding the position. ISS has said that shareholders should withhold their votes on re-electing Marc Andreessen and Peter Thiel, two high-profile Silicon Valley investors, due to their roles on its compensation committee. The group said pay for top executives was based on "vague metrics" such as "making progress on the major social issues facing the internet and our company", and "build[ing] new experiences that meaningfully improve people's lives today". [...] Facebook shareholders have no chance of successfully revolting against the company, due to a dual-track share structure that gives Mr Zuckerberg more than 50 per cent of shareholder voting power despite only having a 13 per cent economic stake in the company.

Days after Teck Resources Ltd. publicly pulled the plug in February on Frontier, a proposed $20.5-billion mine in the oilsands, one of the company’s largest investors started a campaign to oust the company’s chief executive, Don Lindsay. Bob Bishop, founder of Impala Asset Management, a Florida-based resource focused hedge fund, which has been a shareholder since 2016, wrote a letter in late February to the board; and then a few days later, just before coronavirus halted all air travel, he flew to Toronto to deliver his message in person to the company’s chair Sheila Murray: It’s time for Lindsay to go. [...] “This whole oilsands strategy has just been a complete disaster,” Bishop told the Financial Post. While Lindsay declined to comment for this article, it is clear his company, Canada’s largest diversified miner, is struggling through a rough patch. All four of the commodities it produces — coal, copper, zinc and oil — have suffered double-digit price declines. Now investors are suddenly rising up to challenge its once unassailable CEO.

Firms operating in innovative, technology-based environments account for an increasingly significant portion of all recent dual-class IPOs. Shedding new light on the determinants of dualclass structure among such firms, this article contributes to the long-standing debate over the desirability and uses of dual-class stock structure more broadly. In a companion article, that constructed a novel empirical measure of firm founders’ idiosyncratic vision based on media mentions, I demonstrated that expropriation alone cannot adequately explain the tendency of technology-based firms to adopt dual-class structure and that the desire to protect founders’ idiosyncratic vision also drives the choice of stock structure. This article builds on these findings to identify the increased benefits and the reduced costs associated with dual-class structures for firms with significant innovative activity. It argues that placing limitations on dual-class stock structure can prevent such firms from implementing the optimal stock structure needed for the execution of their founders’ vision, leading to suboptimal performance and an increase in firms’ cost of capital. This article analyzes through this lens recent attempts to limit the use of dualclass stock structure.

On October 7, 2019, Institutional Shareholder Services (ISS) released its Proposed Benchmark Policy Changes for 2020, reflecting 17 proposed new policies or policy changes, three of which are applicable to U.S. issuers. ISS is soliciting feedback from governance stakeholders on its proposed benchmark voting policies through 5:00 p.m., ET, on October 18, 2019. The following is a summary of the three proposed policy changes to the ISS United States Proxy Voting Guidelines Benchmark Policy Recommendations.

Do the dynamics of control allocation affect the firms’ performance? Do firms with Dual Class Security Voting Structure (or Multi-Class) tend to perform better than firms with the traditional security voting structure?

Mark Zuckerberg may not have been deposed as part of his humbling settlement with the Federal Trade Commission, but never has his dominance been damaged so dramatically.

The company he founded and built was stung with a $5 billion penalty, but it's the concessions he will have to make that may well give Zuckerberg more sleepless nights.

|

Your new post is loading...

Your new post is loading...